In September 2024, I studied Build-A-Bear (Ticker BBW) as a potential investment. Here is my writeup of the company’s investment case.

Investment Case

| Date | 2024-09-21 | Ticker | BBW | Shares Out’d | 13.7M |

| Price | USD $32.14 | M. Cap | $440M | Current P/E | 9.1 |

| Growth | Avg-6% | 5-yr Price | ~$55 to $62 | 5-yr Earn. Yield | 17% to 21% |

| 5-yr P/E | 5.9 to 4.8 | Upside | ~55% to 92% |

Build-A-Bear is an attractive buy right now.

- Current PE: It’s currently valued at ~ 9x earnings.

- Growth: Modest sales and profit growth (~6%) are expected for the next 5 years.

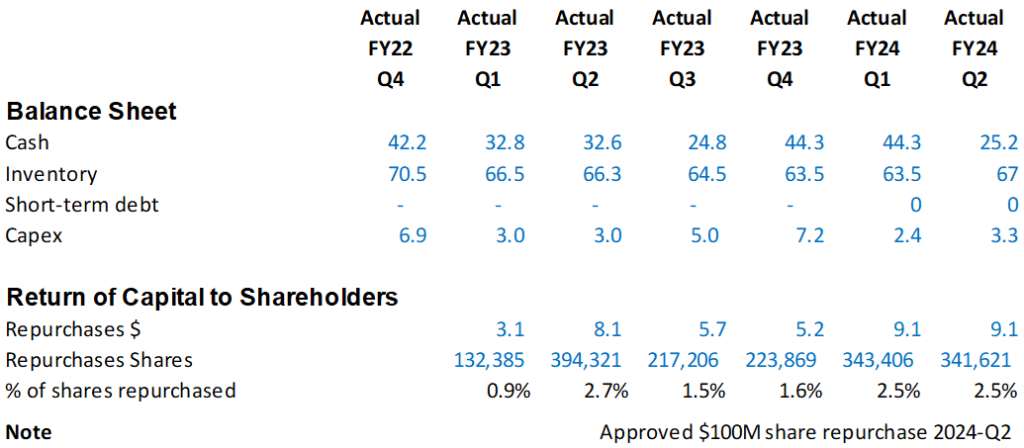

- Debt: It has no long-term debt.

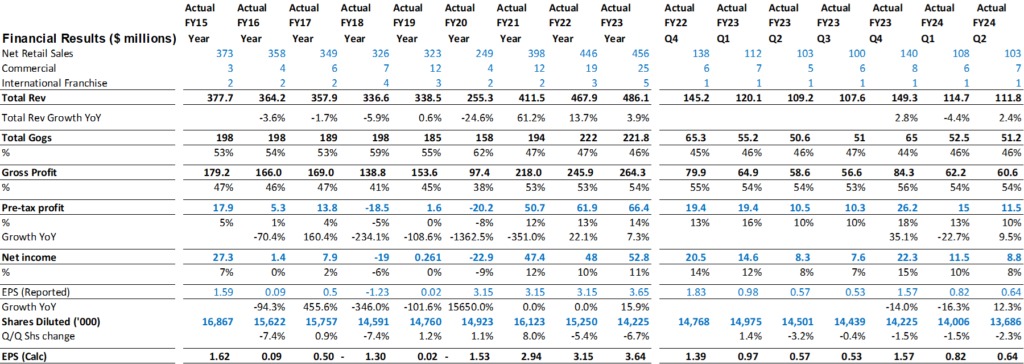

- P&L: TTM, sales are ~$452M and Net Income is ~$48M.

- Margins: Gross margin and net margin have consistently floated around 50% and 10% respectively. These are holding even as operations grow.

- FCF: It has strong FCF (~30 to 45M, lower than earnings due to higher capex spend from location expansion).

- Buybacks: The company is using its FCF to expand profitably and to buy back a lot of stock (low end 5% of shares outstanding each year, however recent quarters suggest 10% per year is likely).

Business

- Core business: The core business centers around selling plush toys (teddy bears, etc.) through experience locations.

- These also act as mini distribution centres for in-store e-commerce fulfillment.

- Products: Product mix is gradually shifting from commodity plush toys to high-value licensed branded items (NFL, Hello Kitty) and collectible or gift-centred items (Halloween, Valentines, Adult-centric).

- TAM: This is allowing the company to expand its TAM from kids to teens and adults.

- Teens and adults buy these higher value items as gifts or from nostalgia of their fond memories of Build-A-Bear as children.

- Strategy: The company is strategically driving this nostalgia with a focus on digital marketing and content creation.

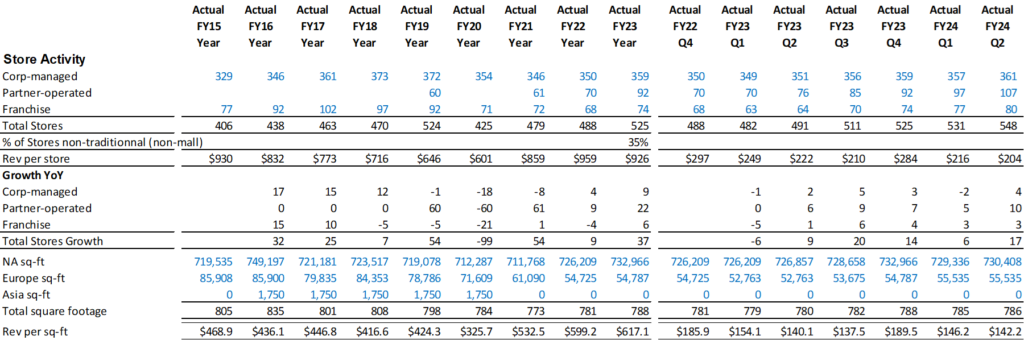

- Locations: Currently, they have ~550 locations. ~400 are in the US, ~60 are in the UK. The rest are in the EU, LTAM, Asia, the Middle-East.

- They are using franchised locations for their international growth (asset-light).

- The CEO expects ~400 locations internationally.

- Business Model Transition: They are transitioning business models from an old, asset-heavy model to an asset-light model (franchising).

- Sales & Profits: Sales and profits have been growing in the low-to-mid-digits (~6%).

- This growth is organic via store openings (have opened ~60 stores in the last 12 months, or a 14% increase) and increased website sales.

- Management expects sales growth to continue at this rate in the coming years.

Management

- Long tenure: The CEO has been with the company since 2013.

- Industry experience: She has lots of experience in advertising, branding and the toy industry.

- Ownership stake (Aligned interest): She owns ~5% of the stock.

- Compensation: The CEO’s compensation is not ridiculously higher than other execs’.

- Clear communication: Their filings and press releases are simple to understand, and have consistently talked about the same strategy since 2017:

- Ecommerce

- More/better stores

- Branding & Gift Giving

- Website optimization

- Loyalty program

- Digital marketing/content

- Profitable growth through investment initiatives + return capital to shareholders

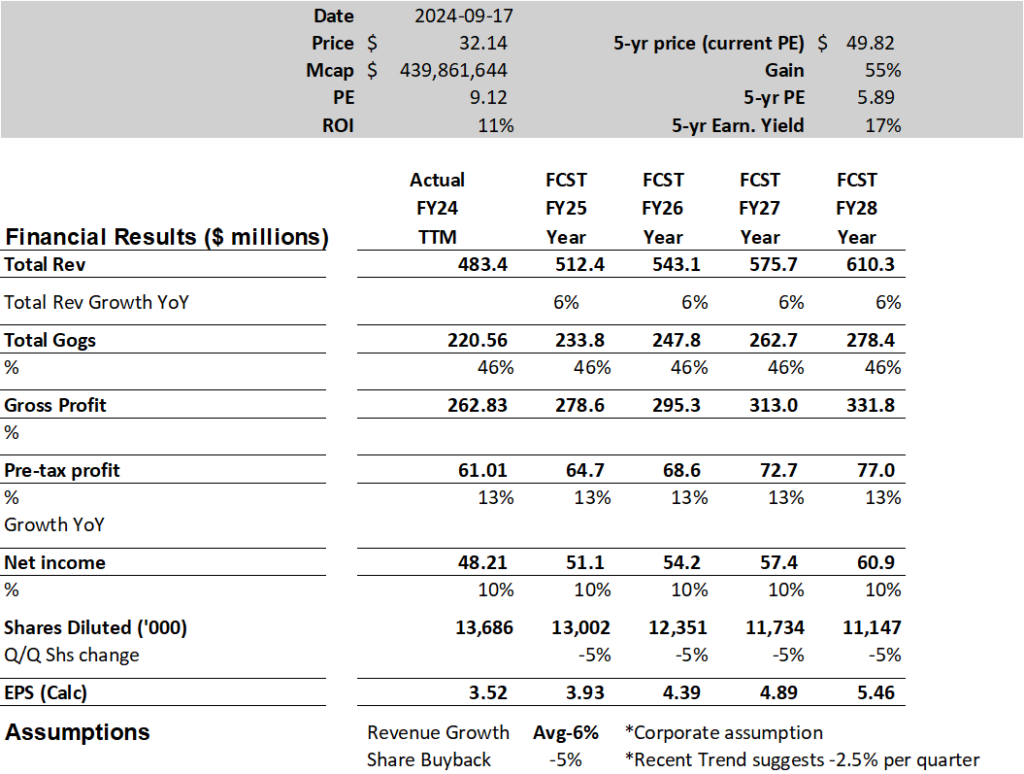

Valuation

BBW Slightly Conservative price in 5 years: ~$50 (55% gain)

- EPS in 5 years: EPS are expected to be ~$5.50

- (yearly 6% profit increases and a conservative 5% share count decline).

- PE in 5 years (current price / 5-yr EPS): expected to be 5.9.

- Price in 5 years: At the current P/E of 9, the 5-year share price would be ~$50 (55% gain).

- Potential Upside: That’s a 17% earnings yield in 5 years.

This does not consider their dividend, ~ $25M in cash, and potential P/E expansion as the value of the company is appreciated by more investors.

BBW Slightly Optimistic price in 5 years: ~$62 (92% gain)

If they bought shares at a 10% rate per year, their 5-year P/E would be 4.74 (earnings yield 21%), with a share price of ~$62 (92% gain).

Again, not factoring any P/E expansion.

A note on my valuation approach

The key 20% of information about a company will tell you 80% about if it’s a good investment or not.

My valuation approach is to see if a company is obviously selling for less than it’s worth.

If not, I pass. If so, I’m interested and keep researching until I feel satisfied with the story.

Concretely:

- I filter and pass severely before rolling up my sleeves, only retaining companies I understand and feel are undervalued.

- I forecast earnings 5 years out and calculate PE and earnings yield at the 5 year mark.

- If the PE and yield are very attractive, I’m interested.

This process allows for easy comparison between high PE, high growth and low PE, low growth companies.

It also lifts 80% of the important weight in analysis.

As far as I can tell, BBW is “on sale”.

Why is the price cheap

- Hangover from prior model, bad past performance: I think people still see the business as a dying, mid-2000s mall business.

- This was their old business model. It was asset heavy.

- The old portfolio of locations had declining traffic, poorer margins.

- This caused them to have weak to no profits for many years pre-2020.

Catalyst

- Business model has changed: However, they’ve already shown several years of transition to an asset-light model.

- New model:

- Based on digital content

- E-commerce

- Leveraging the brand’s nostalgia appeal to grow their TAM

- Making licensing deals with other high margin, high conversion brands to sell specialty toys that garner a lot of interest.

- Good Results: Their good YoY growth, profitability and stable margins show the transition is successful and entrenching itself.

Controlling Risk

Premortem

- The goal of a “Premortem” is to reduce psychological bias by:

- Being a Risk Assessment exercise

- Reduce confirmation bias

- Re-center the mind to objectivity

- Concentrate on disconfirming evidence

- In 5 years, what could cause this investment to go terribly wrong?

- Competitor concentrating on the teddy bear market:

- The toy industry is huge.

- Could a business with $1 B take market share away from Build-A-Bear?

- Yes.

- BBW is very small.

- Its business is somewhat unique, but if toy company competitors wanted to invest millions into the teddy bear market and develop teddy bear making destinations, I could see them eroding market share and sales for BBW.

- Disaster-scenario consequences:

- If market share is eroded/collapsed and shrunk, with sales declining every year, I could see the P/E cratering from 10 down to 5.

- That would lose at least 50% of the investment over 5 years, likely more if profits drop as well.

- Competitor concentrating on the teddy bear market:

Mitigating factors

- Small niche makes huge competition less likely

- Precisely because BBW is so small, I think the risk of competitors explicitly entering the business and taking market share is remote for many years.

- Disclosures state they are in a cottage industry and have few direct competitors (all small and regional).

- This leaves BBW a runway, flying ‘under the radar’, to execute its strategy and grow the value of the business.

- Brand: BBW has an entrenched brand, a unique experience offering, loyal customers, and they are ramping up efforts to reinforce the value of their brand and loyalty via content creation, advertising, marketing and collaborating with other well-known brands via licensing.

- No debt: If the business were to suffer, there are virtually no liabilities that would threaten equity investors.

- Low Valuation: The current PE of 9 is very reasonable. The probability of the valuation “crumbling” and wiping significant capital is very low.

Opinion

Considering the above, I believe a disaster case scenario that would crater capital as very unlikely.

Whereas the benefits presented by the business model shift, its the future growth, and the attractively low valuation, present solid, lucrative potential.

I believe BBW is a good purchase.

Financials

Income Statement

Balance Sheet Items

Forecast

Store Count