Stockanalysis.com

Company & Business

CF Industries manufactures and sells ammonia. It is the worlds’ #1 producer. CF’s largest costs are from natural gas feedstock used to produce ammonia. It’s revenue is primarily derived from selling ammonia and fertilizers, sold at commodity market prices.

Fertilizers are not all equal. Nitrogen fertilizers are applied every year by necessity. Nitrogen is a crucial ingredient for crop yields. Demand is very stable and sticky. This differs to other fertilizers where farmers can delay application without immediate negative effects on yields, like potash and phosphate. Ammonia has stable demand.

Ammonia is roughly 80% nitrogen and 20% hydrogen. It is primarily sold as nitrogen fertilizers in the form of urea and ammonia nitrate. 70% of the company’s ammonia production is sold as nitrogen fertilizer. The company also sells upgraded products such as diesel exhaust fluid (#1 supplier in North America). It is beginning to market and sell blue ammonia, which is produced with significantly less carbon output and sells for a premium. The company is also developing a market for ammonia as a store of energy as it is more stable and transportable than pure hydrogen.

Industry Cost Curve

CF industries is very low on the cost curve. It has very favorable feedstock prices from North American natural gas. Its main production plants are situated in the USA along the Mississippi river, allowing access to the world seaborne market, and the large inland American import market for fertilizers at low transport costs.

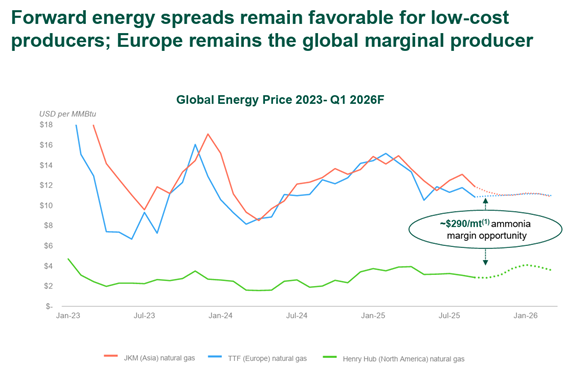

Ammonia is produced from a carbon source, primarily natural gas but also from coal (i.e. China largely for internal market). Natural gas is the cheapest feedstock to produce ammonia. Around 70% of the cost to produce ammonia is natural gas feedstock. Operating in North America, CF industries has the world’s lowest natural gas costs.

Over the past 5 years, there has been a steep natural gas price differential between the two biggest producer regions, NA and Europe, due to the Ukraine war halting Russian gas flows to Europe. This is harming margins for European producers.

Every year that Europe’s natural gas remains at these elevated levels entrenches CF’s competitive position. As time goes on, more marginal high-cost producers permanently close, reducing long-term supply. Over the last 5 years, we have already seen dozens of ammonia manufacturing plants permanently close in Europe. Five years ago, Europe had around 50 ammonia plants. They now have around 30 plants, with another ~5 likely to close in the coming years.

CF 3Q25 presentation

CF 3Q25 presentation

Favorable Supply and Demand dynamics

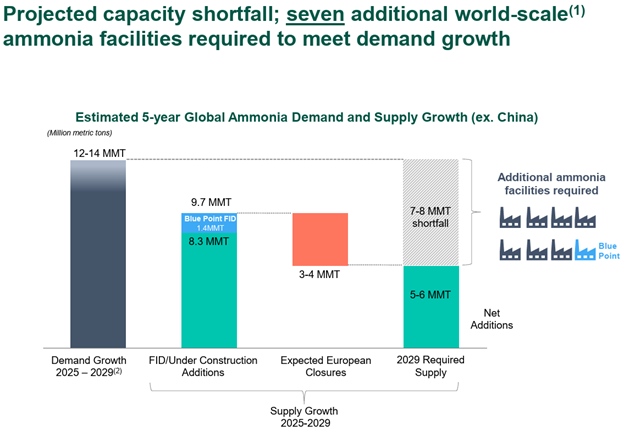

The ammonia market is entering a prolonged period of tightness. Demand is increasing every year by 1 to 2%, and new supply projects are scarce. This is a favorable dynamic for CF’s revenue. At the same time, CF is developing a new ammonia production plant in a joint venture, Blue Point in Louisiana, which will increase its capacity by 10%. It is one of the few projects adding capacity to the market.

Some data points driving constrained global supply of ammonia include the war in Ukraine, high gas costs in Trinidad causing shutdowns, high European gas costs causing shutdowns, plants coming offline in Saudi Arabia and Bangladesh, little new capacity coming online in low-cost areas (NA). All the while demand is growing in India, Brazil and North America.

It’s hard to find a skeleton in the closet. The demand-supply conditions are favorable and not likely to change.

CF 3Q25 presentation

Risks

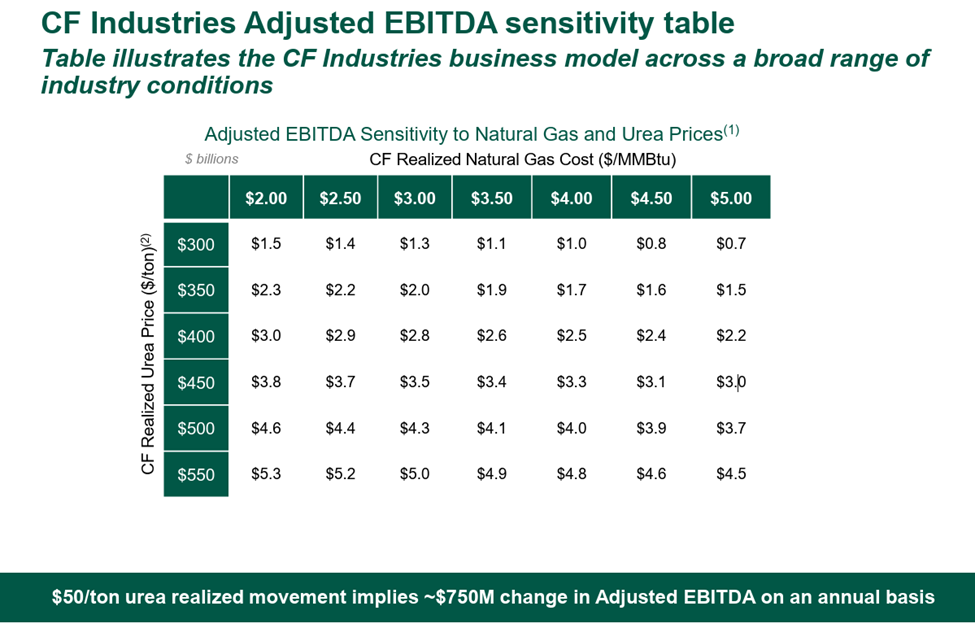

The primary risk with CF is that natural gas spreads costs in NA rise, leading to margin compression. However, this is mitigated by recent plant shutdowns in Europe that are permanent in the short to mid-term, and low additional supply projects over the next decade, putting upward pressure on sale prices. On balance, if North American input costs rise, CF doesn’t stand to lose profitability because supply constraints will drive up sale prices, preserving margin. On the other hand, it stands to increase profits over the next 5 to 10 years if its North American input costs remain low and market prices for ammonia and nitrogen fertilizers are pressured upward from supply constraints. Heads I win, tails I don’t lose much.

Natural gas is a commodity and something unforeseen could disrupt the current global cost dynamics. There is always a risk that in the future North American natural gas prices rise dramatically, or that Europe regains access to cheap and plentiful natural gas. However, long lead times in onboarding new ammonia plants provide near term protection on product pricing.

Management

CF’s longstanding CEO, Anthony will, just retired at the end of 2025. He was CEO since 2014 and joined the company in 2007. His successor, Chris Bohn, was previously COO and CFO before that. He has been with the company since 2009.

Management members are longstanding, consistent in what they say and do, and are very clear on management calls. They sound like real people. They are sharp, insightful and passionate about their business and industry.

Value

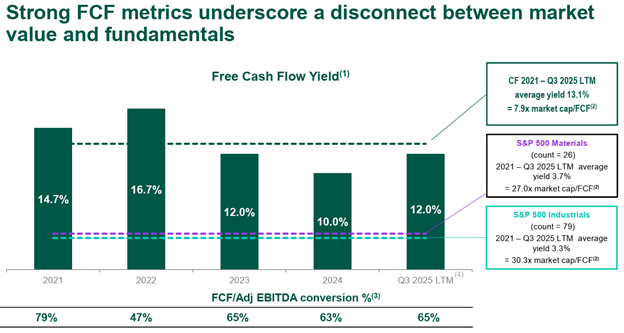

We believe the company is selling cheap at 10x baseline FCF, with cash flows expected to increase with market prices. The stock price has increased as of late. It still looks like a great cash yield for strong fundamentals.

The management team shares the opinion that their shares are undervalued in the market. They have been buying back shares for years. Management believes the market is confounding their ammonia business with the wider fertilizer industry.

Seed and chemical companies are facing headwinds from expiring patents, distribution channel destocking and declining margins. Other fertilizers like potash and phosphate have more demand volatility. Industrial and materials businesses suffer from overcapacity and sluggish demand.

CF’s ammonia business suffers from none of these headwinds and produces more steady cash because ammonia demand is inelastic with constrained supply.

We believe the most likely scenario is for CF’s tailwinds to hold and become stronger over time. It will likely keep benefiting from being the low-cost producer. It will benefit from demand outstripping supply for its products, which will increase revenue. Their stable cost base means this additional revenue will grow gross margin and earnings. It is in the process of expanding its production capacity into this favorable supply and price environment. All of these will likely translate into attractive FCF increases over the medium term for a business that is already selling for an attractive 10% FCF yield.

CF 3Q25 presentation

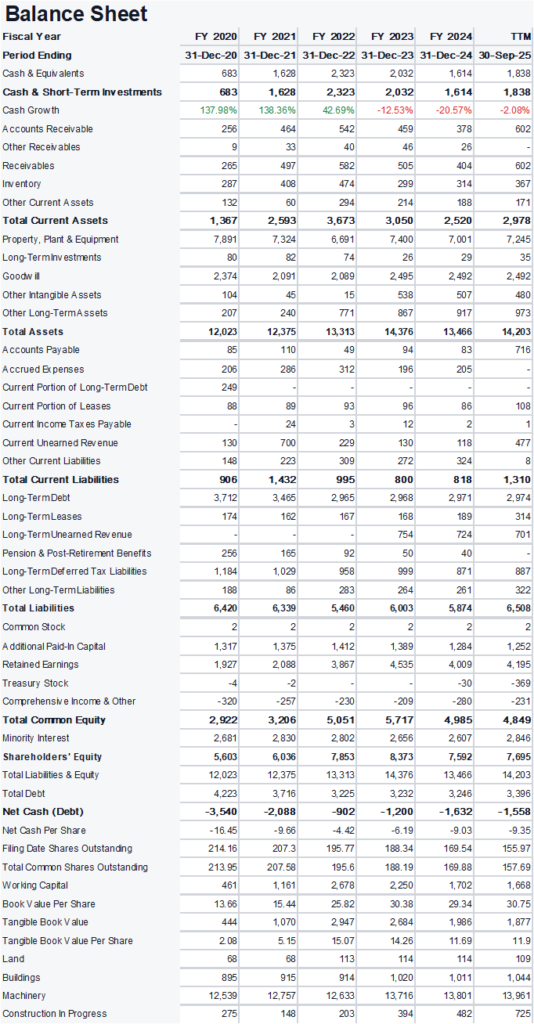

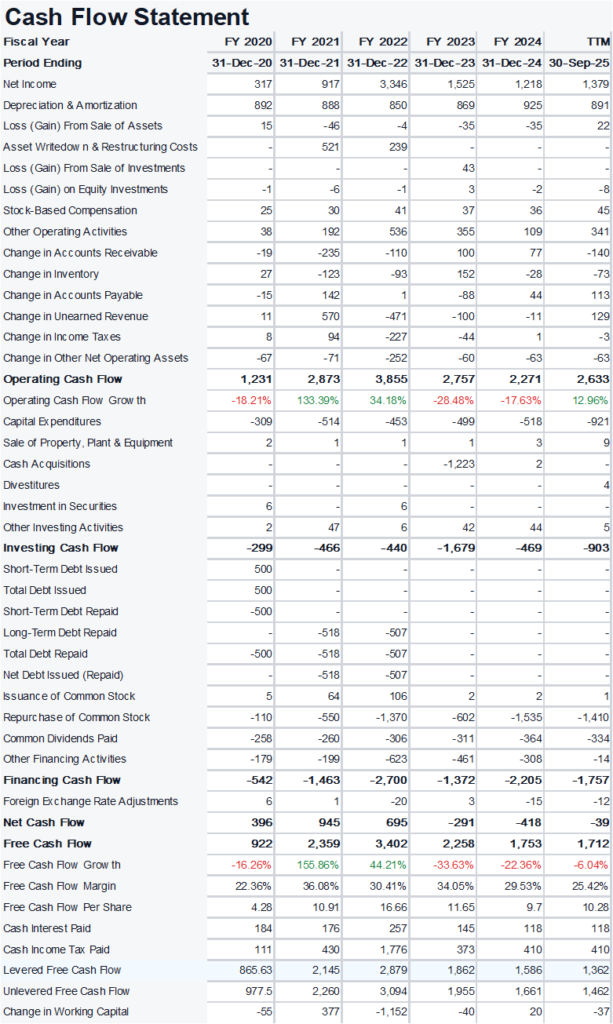

Appendix: Financials (Millions of USD)

Income Statement Notes

- 2022 and 2023 saw Urea prices spike due to constrained supply from Ukraine at the outbreak of the war. This significantly increased Revenue. Higher pricing for their products does not mean higher production costs for the company, and these price increases dropped straight to earnings. Urea prices have come down but stabilized higher than pre-war levels. Plant closure and limited new supply are expected to put upward pricing pressure on end-product fertilizers.

Balance Sheet Notes

- CF has significant Cash. Long-term debt is low, under 4x normalized FCF.

- AP is seasonal and runs high Q1-Q3, dropping in Q4 as fertilizers are sold for the growing season and paid in fall and winter.

Cash Flow Notes

- Current baseline FCF is around $1.5M per year. This is expected to increase over time as market tightness increases prices for their products. This translates currently to a FCF to market cap ratio of around 10x.

Stockanalysis.com

Stockanalysis.com

Stockanalysis.com